Investing in economic development projects with lasting impact

Our New Markets Tax Credit (NMTC) program supports high-impact community development projects that benefit underserved areas. Fueled by allocations of tax credits from the US Department of the Treasury, BlueHub’s NMTC program facilitates private investments and lowers the cost of capital for community development projects that provide access to high-quality services for low-income people and communities. BlueHub Capital has received ten allocations totaling $608 million from this very competitive program.

Our investment strategy

We identify high-impact projects in low-income areas that, without the substantial below-market private investment from the NMTC, could not get off the ground or expand. Typically, these projects are community facilities that deliver high-quality, sustainable services for local residents. We then bring in national equity investors to finance these projects at very favorable rates, providing savings that make the projects economically sustainable.

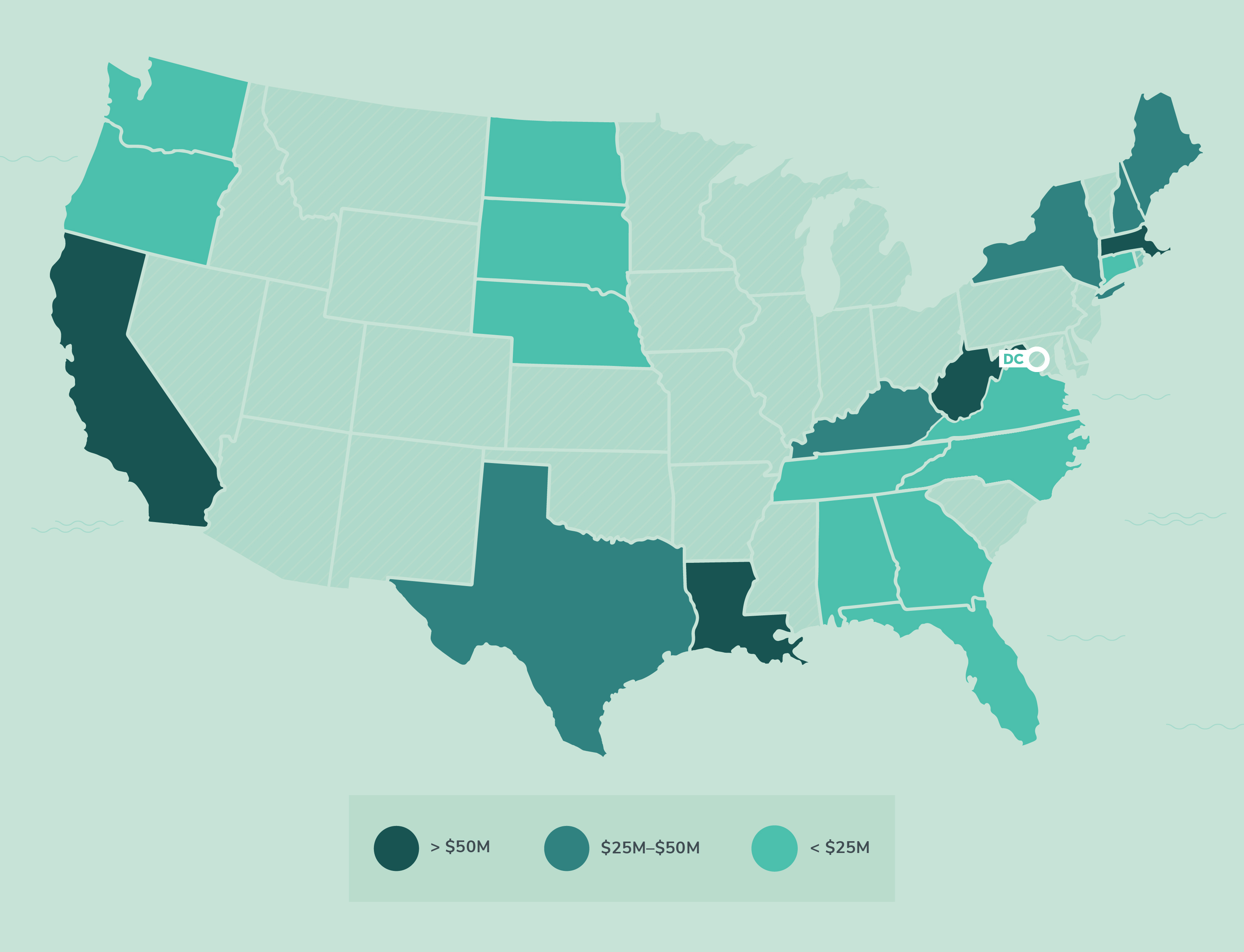

Where we work

We work nationally and have deployed NMTC allocations in 21 states. We partner on community development projects in the nation’s most underserved urban communities. Examples include: community facilities such as a healthcare center, social service organization and schools in Connecticut, Tennessee, North Carolina and Massachusetts.