SUN Blog

Featured post

Filter by

Post Results

New Tax Laws for Homeowners: What to Know & Where to File for Free

The 2025 One Big Beautiful Bill Act makes major tax changes affecting homeowners. The SALT deduction cap rises to $40,000 (2025–2029), mortgage interest limits stay at $750,000, and many home energy credits end after 2025. These updates may affect itemizing decisions and deductions. Homeowners should review carefully and seek professional tax advice.

How to Rebuild Your Credit in 12 Months: A Complete Plan for 2026

Credit scores weigh heavily on a homeowner's ability to borrow money. This actionable guide provides a month-by-month strategy to improve your credit score steadily over time.

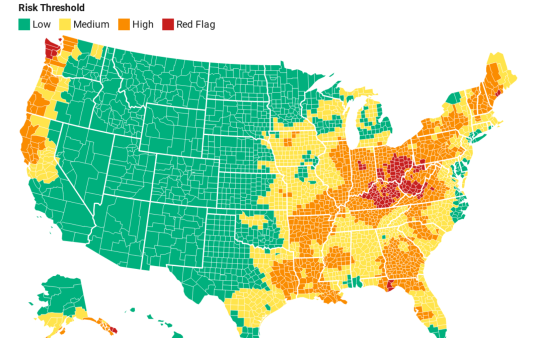

How Climate Change Is Impacting the U.S. Housing Market — What It Means for Housing Professionals

Climate change is reshaping the U.S. housing market, driving higher insurance costs, shifting migration patterns and increasing disaster impacts. Rising premiums, insurer retreat and growing hazard exposure are eroding property values—potentially up to $1.4T in 30 years—creating new risks for homeowners and requiring housing professionals to integrate climate-risk planning into their work.

How Homeowners Can Keep Their Holiday Budget on Track

The holidays bring joy but also financial strain for homeowners managing mortgages, utilities, and seasonal spending. With heating and property taxes rising, careful budgeting is key. Set spending caps, plan for higher utilities, and share costs when hosting. Smart planning helps you enjoy the season without jeopardizing financial stability or your home’s security.

BlueHub SUN: The Foreclosure Relief Program

BlueHub SUN, launched in 2009, helps families avoid foreclosure, reduce debt, and remain in their homes. SUN has saved over 1,000 families from eviction, cut mortgage amounts by an average of $90K, lowered monthly payments, and restored $67.5M in equity to the homeowners—earning recognition as a national model for stabilizing communities.

What Rising Insurance and Property Taxes Mean for You

Property taxes and insurance costs are rising, raising monthly housing bills for many homeowners. SUN clients should know that while loan payments stay the same, taxes and insurance in escrow can change. Review your statements, open all mail, shop around for insurance, and ask your town about tax relief. Have a Capital Reserve Account? It may help with unexpected costs.

2025 Foreclosure Rate Mid-Year Update

Foreclosures rose nearly 6% in early 2025 vs. 2024, with 187K+ filings nationwide. Starts rose 7%, REOs 12%. High rates seen in IL, DE, NV, FL, SC. CT, DE, IL showed above-average rates. Legal help demand surged 30%. Rising home values helped some avoid foreclosure. BlueHub SUN offers support to at-risk homeowners.

Scam Alert: What to Watch for and How to Protect Yourself

Scams targeting homeowners are getting more advanced. Stay safe by learning the red flags—like urgent messages, fake links, or requests for payment via gift cards or apps. Common scams include fake toll texts, voice cloning, mortgage relief offers, and tech support pop-ups. Always verify directly and never act on pressure alone.

Spring Home Cleaning 2025: Easy and Low-Cost Ways to Care for Your Home

Spring is the perfect time to check in on your home. Our easy checklist covers appliance care, filter changes, outdoor maintenance, and safety tips—with helpful how-to videos. Plus, learn how your Capital Reserve Account (if you have one) can help cover unexpected home repairs.

How Credit Impacts Housing: Insights from Credit Strategist Brian Blackmore

Credit plays a powerful role in access to stable housing—but many people are navigating it without the tools or education they need. Credit strategist Brian Blackmore shares what he’s learned from helping clients rebuild their credit, break harmful cycles, and avoid common pitfalls. From misinformation to high interest rates, he offers insight into what’s broken—and how housing professionals can help.