As of August 2024, foreclosure activity in the US showed a decline in both foreclosure starts and completed foreclosures. According to a recent foreclosure report by ATTOM, a market research firm, there were 30,227 properties with foreclosure filings in August nationwide. This represents a 5.3% drop from July 2024 and an 11% decrease compared to August 2023.

Foreclosure filings are still well below pre-pandemic numbers, when over 270,000 properties were in foreclosure. The number of completed sales in July (approximately 5,500) increased 3.7% month-over-month but were down 9.6% from this time last year and still less than half of 2019 averages. Additionally, according to the Mortgage Bankers Association National Delinquency Survey through Q2 2024, the percent of seriously delinquent loans in the foreclosure process decreased year-over-year from 0.53 percent in Q2 2023 to 0.43 percent in Q2 2024 and remains historically low.

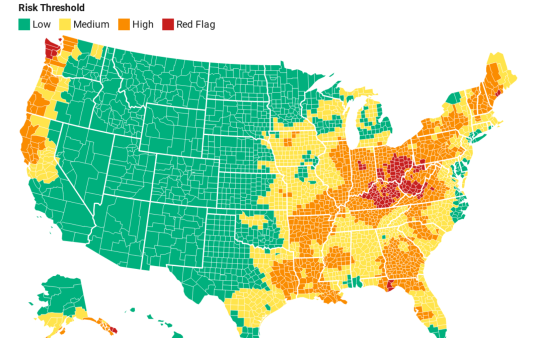

Despite the historic lows in foreclosure activity, some states continue to see elevated foreclosure rates, driven by economic factors like rising interest rates and housing affordability challenges.

Key Takeaways:

- Foreclosure starts were down 5.1% from July and 9.4% from August 2023.

- Completed foreclosures dropped 12% from July 2024 and 13.9% from August 2023.

- One in every 4,662 housing units had a foreclosure filing in August 2024.

What’s Happening by State?

Nevada, Florida and Illinois posted the highest foreclosure rates in August 2024, with one in every 2,473, 2,605, and 2,837 housing units in foreclosure, respectively. South Carolina and New Jersey followed closely behind. Florida, California and Texas led the nation in foreclosure starts, with Illinois and New York also seeing significant foreclosure activity.

Rob Barber, CEO of ATTOM, stated, “Foreclosure activity has remained relatively steady in recent months, with both foreclosure starts and completed foreclosures declining in August."

States such as Pennsylvania, California and Illinois also saw high numbers of completed foreclosures (REOs).

A Closer Look at the States BlueHub SUN Serves:

The following data, provided by ATTOM, is from the first half of 2024, offering a detailed state-by-state look at foreclosure trends.