Foreclosures were down 10% across the US in 2024, year-over-year—322,103 properties were reported to be in some stage of the foreclosure process during the year, according to ATTOM, a market research firm. Foreclosure starts, or initial legal filings required to start the process, were down 6% from 2023. Bank repossessions or REOs were down 13%.

The highest numbers of REOs were in California, Illinois, Pennsylvania, Michigan and Texas. States with the highest foreclosure rates per household unit in 2024 included Florida, New Jersey and Nevada. In large metro areas, Lakeland, FL, Atlantic City, NJ and Columbia, SC, saw the highest foreclosure rates.

Shifting Trends in the Housing Market

According to Rob Barber, CEO at ATTOM, the continued drop in foreclosures “suggests a housing market that may be stabilizing, even as economic uncertainties persist. This year’s data points to foreclosure trends potentially returning to more predictable levels, offering some clarity for industry professionals, investors, and homeowners.” Barber pointed to “careful lending practices and ongoing homeowner resilience” as potential reasons for the decline.

Indeed, credit quality of newly originated loans remains strong as two-thirds of newly originated mortgages in Q4 went to borrowers with credit scores above 760, according to the New York Federal Reserve. However, mortgage delinquencies have not followed the same trajectory as foreclosure; delinquencies rose 4% year-over-year – the seventh consecutive annual increase – ending 2024 near a three-year high, according to Intercontinental Exchange, Inc., a data provider.

Rising Home Prices and the Impact on Foreclosure Activity

While foreclosure activity declined in 2024, US home prices continued to trend upward. As stated by Zillow, the average home sale price in December 2024 was $356,585 —a 2.6% increase from the previous year (though in real, inflation-adjusted numbers, the Case-Shiller National Index is 1.3% below the recent home price peak in 2022).

Compared to pre-pandemic sale prices, 2024 sale prices increased significantly, 26% from December 2019 when home prices averaged $265,813. The large increase in property values since 2019 may cause homeowners struggling to make mortgage payments to sell their homes to avoid foreclosure, according to Scotsman Guide Inc., which tracks mortgage industry trends and data.

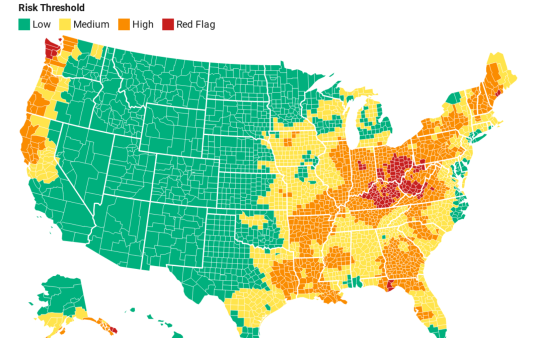

Regional Foreclosure Trends in 2024

Despite rising property values and national trends pointing to foreclosure activity stabilizing in 2024, most states where BlueHub SUN operates continued to see high rates of foreclosure filings compared to the national average.

National Average

There were 28,632 properties with foreclosure filings in the United States in December 2024 (1 in every 4,922 housing units).