How to Rebuild Your Credit in 12 Months: A Complete Plan for 2026

Credit scores weigh heavily on a homeowner's ability to borrow money. This actionable guide provides a month-by-month strategy to improve your credit score steadily over time.

Credit scores weigh heavily on a homeowner's ability to borrow money. This actionable guide provides a month-by-month strategy to improve your credit score steadily over time.

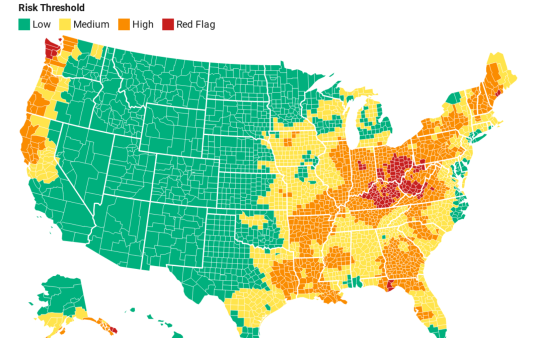

Climate change is reshaping the U.S. housing market, driving higher insurance costs, shifting migration patterns and increasing disaster impacts. Rising premiums, insurer retreat and growing hazard exposure are eroding property values—potentially up to $1.4T in 30 years—creating new risks for homeowners and requiring housing professionals to integrate climate-risk planning into their work.

BlueHub SUN, launched in 2009, helps families avoid foreclosure, reduce debt, and remain in their homes. SUN has saved over 1,000 families from eviction, cut mortgage amounts by an average of $90K, lowered monthly payments, and restored $67.5M in equity to the homeowners—earning recognition as a national model for stabilizing communities.

Foreclosures rose nearly 6% in early 2025 vs. 2024, with 187K+ filings nationwide. Starts rose 7%, REOs 12%. High rates seen in IL, DE, NV, FL, SC. CT, DE, IL showed above-average rates. Legal help demand surged 30%. Rising home values helped some avoid foreclosure. BlueHub SUN offers support to at-risk homeowners.

Credit plays a powerful role in access to stable housing—but many people are navigating it without the tools or education they need. Credit strategist Brian Blackmore shares what he’s learned from helping clients rebuild their credit, break harmful cycles, and avoid common pitfalls. From misinformation to high interest rates, he offers insight into what’s broken—and how housing professionals can help.

Discover key insights on 2024 foreclosure trends, with national and regional highlights sourced from ATTOM. Learn how foreclosures decreased by 10% year-over-year, while states like Florida, New Jersey, and Nevada saw the highest foreclosure rates. Explore data on credit quality, rising home prices, and the impact on foreclosure activity, providing valuable takeaways for housing professionals and industry experts.

The CFPB proposed new mortgage servicing rules to prioritize borrower assistance over foreclosure, streamline loss mitigation processes, and improve communication. Key changes include limiting fees during reviews, simplifying applications, and requiring clear, multilingual notices. Aimed at reducing preventable foreclosures and enhancing transparency, the rules may take effect by late 2025 or early 2026, pending finalization.

The August 2024 foreclosure report shows a slight decline in US foreclosure activity, with 30,227 filings nationwide. Key states like Nevada, Florida, and Illinois lead in foreclosure rates. The second half of the report provides detailed data on foreclosure trends in states served by BlueHub SUN, including Connecticut, Illinois, and Delaware.

The U.S. faces a housing crisis for seniors, with the 65+ population rising by 34% in 2022. Financial challenges like rising property taxes, insurance premiums, and mortgage debt threaten the ability of older adults to maintain homeownership. Nearly 11.2 million seniors spent over 30% of their income on housing in 2021. Solutions include tax relief, refinancing, and accessing home equity through safe methods like HUD-certified counselors.

In 2009, Connecticut attorney Theresa DeGray, despite being a lawyer, was overwhelmed by debt and filed for bankruptcy. This experience inspired her to help others avoid foreclosure. At her firm, Consumer Legal Services, LLC, she assists homeowners in navigating bankruptcy, striving to end its stigma. DeGray uses her story to build trust and show clients they can overcome financial difficulties.