New Program Provides Funding to Homeowners Impacted by COVID-19

In January 2022, the American Rescue Plan Act (ARPA) created the Homeowner Assistance Fund (HAF), a $9.961 billion federal program to help households impacted by COVID-19. HAF is already helping thousands of homeowners pay mortgage, utility bills and other housing expenses. Homeowners are eligible to receive funding if they have and can attest to financial hardship experienced on or after January 21, 2020. They must also have household income equal to or less than 150% of the area median income or 100% of the national median income, whichever is greater.

HAF participants can provide HAF funds only for qualified expenses related to a primary residence. Homeowners must use the funds to prevent mortgage delinquencies, defaults or foreclosures or loss of utilities or home energy services. Qualified expenses include:

- Mortgage payment assistance

- Financial assistance to reinstate a mortgage or pay other housing-related costs related to forbearance, delinquency or default

- Mortgage principal reduction, including second mortgages from nonprofits or government entities

- Mortgage interest rate reductions

- Payment assistance for delinquent property taxes to prevent foreclosure

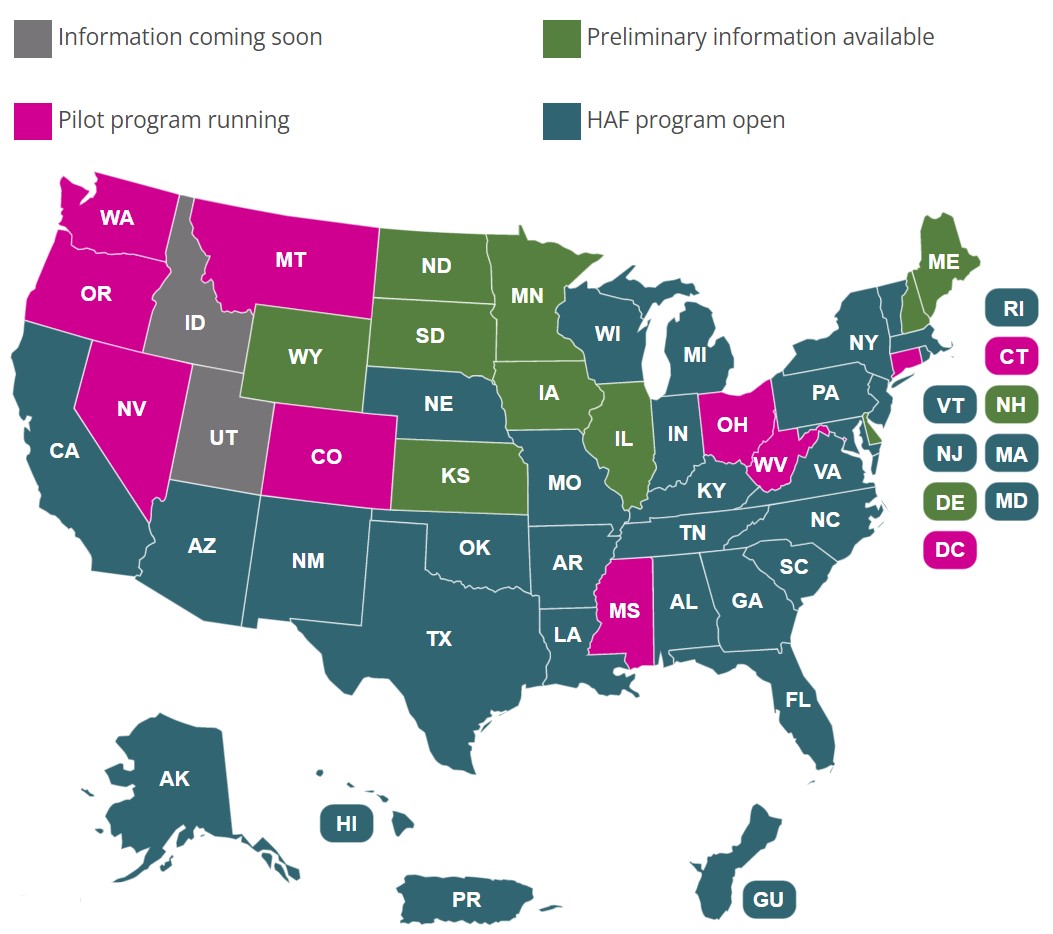

How is it working in your state?

Already, nearly 30 states have HAF programs. The rest are hard at work getting theirs off the ground. See below for details on the 11 states where BlueHub SUN is licensed for a status update.

If you have clients who are ineligible for the HAF program or who live in a state where it’s currently unavailable, we encourage you to consider BlueHub SUN as an alternative solution.

*The map is subject to change over time. To see the most recent version, go to the NCSHA website.