Foreclosures rose nearly 6% across the U.S. in the first half of 2025, compared to the first half of 2024, with 187,659 properties reported to be in some stage of the foreclosure process, according to ATTOM data. Foreclosure starts — the initial legal filings that initiate the process — increased 7% compared to the same period in 2024. Bank repossessions (REOs) were also up, rising 12% during the first six months of the year.

The highest number of REOs occurred in Texas, California, Pennsylvania, Illinois and Michigan. States with the highest foreclosure rates per household unit in the first half of 2025 included Illinois, Delaware, Nevada, Florida and South Carolina. In large metro areas, Lakeland, FL, Columbia, SC and Chicago, IL saw the highest foreclosure rates.

Shifting Trends in the Housing Market

According to Rob Barber, CEO of ATTOM, the rise in foreclosure activity “suggests that some homeowners are still facing financial challenges amid today’s housing and economic landscape.” While overall foreclosure numbers remain lower than before the pandemic, the steady increases in both starts and completions point to ongoing stress for borrowers.

The average time to complete a foreclosure dropped to 645 days in Q2 2025, the third consecutive quarter of decline, suggesting that courts and lenders are moving more quickly through the process. Meanwhile, demand for legal help has grown. In Q2 2025, foreclosure-related legal inquiries rose nearly 30%, reaching their highest level since 2020, according to LegalShield’s Consumer Stress Legal Index. LegalShield cited “rising insurance premiums, property tax reassessments and adjustable-rate mortgage resets” as reasons for the increase.

Rising Home Prices and the Impact on Foreclosure Activity

Home prices continued to rise in the first half of 2025, which has helped many homeowners avoid foreclosure by selling their homes before losing them. According to Zillow, the typical U.S. home value was $369,147 in June 2025, a slight increase from $360,681 in June 2024. When adjusted for inflation, prices remain just below the 2022 peak, but they are still more than 25% higher than pre-pandemic levels.

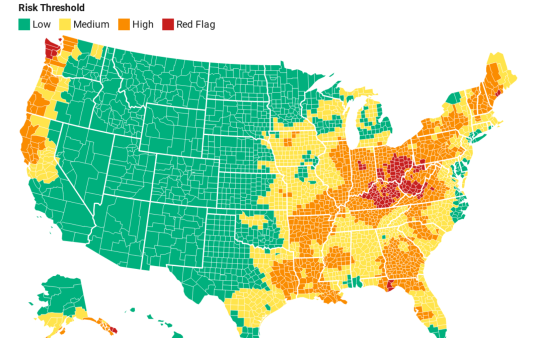

Regional Foreclosure Trends in 2025

Despite steady home price growth and national foreclosure rates remaining below pre-pandemic levels, many states where BlueHub SUN operates continue to see foreclosure rates above the national average.

In the first half of 2025, there were 187,659 foreclosure filings nationwide — or 1 in every 758 housing units.

A Closer Look at the States BlueHub SUN Serves