Important Program Update (Effective Nov. 14, 2025):

*As of November 14, 2025, BlueHub SUN has paused lending to homeowners who are underwater on their mortgages. This pause will remain in place until there is further clarity from the Massachusetts courts. BlueHub SUN will continue offering refinancing to homeowners in foreclosure who have equity in their homes. Read more.

How we use a shared appreciation mortgage

There’s a common thread among BlueHub SUN clients: They’re in default or foreclosure, often facing eviction and with nowhere else to turn. Many haven’t paid their mortgage for a long time. Some are underwater on their mortgage. They often find us through referrals from housing counselors and legal aid or government agencies. We work with our clients to help them retain and regain homeownership.

Once potential SUN clients apply and are conditionally approved for a new mortgage, BlueHub SUN advocates for its clients and negotiates with the original foreclosing lender to try to persuade them to sell the home to SUN at a lower price. Throughout this months-long process, SUN staff assists its clients through each step.

If a client is underwater on their mortgage, foreclosing lenders, as a general rule, will not sell us the defaulted loan. They will only sell us the home. So, even though it makes for a more complicated transaction, the only way SUN can work is for SUN to buy the home from the client—or their foreclosing lender if they’ve lost title—and sell it back to the homeowner at a price they can afford with a fixed-rate mortgage. The lender releases the homeowner from all prior mortgage obligations, and we process a new loan that reflects the home’s actual value. Now, instead of being underwater, the homeowner has the opportunity to earn equity immediately.

SUN clients come away with a reduced mortgage and relieved from past debt they never have to pay back. In return, they have a shared appreciation mortgage (SAM), a second mortgage based on the percentage saved on the previous mortgage.

How the SAM Works (4-Min Video)

Why SUN uses a SAM

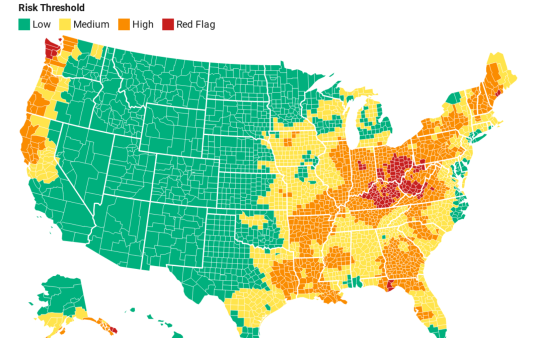

Share appreciation mortgages are not unique to SUN. The concept took root in the 1990s and is now used by local housing authorities, nonprofits, private companies, colleges and universities, and municipalities across the United States. A SAM comes with the condition that clients pay it only if their home value increases, and only when they decide to exit the program by selling their home, refinancing out of their mortgage loan, or when the mortgage loan term ends.

The banking industry required BlueHub SUN to use a shared appreciation mortgage to dissuade homeowners from purposefully not paying their mortgage to get the principal reduction offered by SUN. The reduction to their mortgage principal results in smaller monthly mortgage payments that let homeowners regain their financial footing and reestablish their savings.

Benefits and outcomes

Over 40% of SUN clients have paid off their mortgage—and, where applicable, their SAM—and successfully exited the program. Because they’ve had the chance to repair their credit, they have access to a conventional mortgage and save even more money.

As a nonprofit, we use money from SAMs to further our mission of building healthy communities where low-income people live and work – a win-win for homeowners and their neighborhoods.