Nationwide: Signs of increasing affordability

This spring, despite rate hikes and inflation, things look more hopeful for homebuyers than last year. The reasons for these brighter prospects? Modest increases in home prices and rising wages.

At the end of March, ATTOM Data revealed an increase in median single-family home and condo prices of just under 1% from Q4 ’22 to Q1 ’23. It’s a welcome trend that comes on the heels of an 8% drop in US median home prices over the last six months of 2022 and 6% wage growth – a boost for the average homebuyer’s budget. So, while the market continues to price out some homebuyers, there are increasing signs of affordability nationwide.

What’s happening by region and state?

According to the National Association of Realtors (NAR), existing single-family home sales jumped 14.5% in February, the largest monthly gain in over two years. This can be partially attributed to the fact that Q1 ’23 median home prices in 6% of US counties analyzed by ATTOM Data are more affordable than in the past—up from 1% in Q4 ‘22.

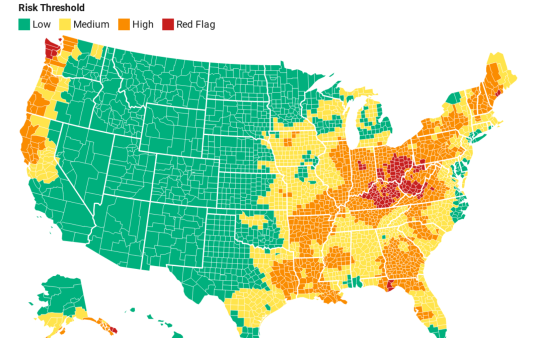

Additionally, In Q1 ’23, the median price of homes sold in the U.S. increased only slightly from Q4 ‘22 to $320,000. At the local level, median home prices in Q1 ‘23 remain up year-over-year in 65% of counties analyzed. Meanwhile, price increases in the last decade have leveled median home values, affecting home equity in most markets. Check out the latest data from NAR Local Market Reports. Here’s a Q4 ’22 snapshot of the states BlueHub SUN serves.