Home Prices to Remain High

According to the St. Louis Federal Reserve, the Q2 2022 median price of houses sold in the US reached an all-time high of $428,700. And three factors suggest they may stay that way: strong household balance sheets, higher propensity to spend on housing after the post-pandemic shift to remote work, and limited housing supply that will keep demand high.

Meanwhile, economists believe rising interest rates could add to homeowner debt burdens by increasing repayment amounts. Borrowers with variable-rate mortgages will feel the pinch immediately compared to those with fixed rates.

Furthermore, sustained price increases and higher rates have dampened affordability. And while average US household wealth has grown significantly since the 2008 financial crisis, many homeowners have more debt than ever.

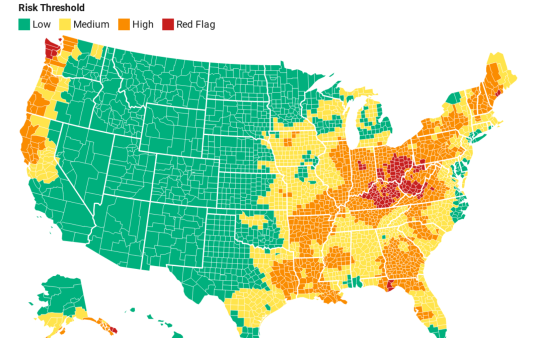

What's happening by region and state?

In April 2022, the median sales price of homes sold in the US was $450,600 (US Census Bureau). According to the National Association of Realtors, Q1 prices for single-family existing homes jumped 6.7% in the Northeast, 8.5% in the Midwest, 5.9% in the West and a staggering 20% in the South.

That translates to double-digit annual increases in median single-family existing-home prices for 70% of metro areas. In the same year, monthly mortgage payments on single-family home purchases with a 20% down payment shot up 30%, accounting for 18.7% of household income versus 14.2% a year ago.

Here’s a snapshot of median home prices, one year appreciation rates and loan-to-income ratios in the states BlueHub SUN serves, based on NAR Local Market Reports for Q4 2021: