Current HAF Requirements and Status

Here’s the latest on the Homeowner Assistance Fund grant program for mortgage relief in BlueHub SUN service areas as of August, 2023.

What is the Homeowner Assistance Fund?

The Homeowner Assistance Fund (HAF) provides grants in limited amounts to homeowners struggling financially because of the pandemic. The federal government established this nearly $10 billion federal program in 2021 to provide states, territories and tribes with the funds to support homeowners in underserved communities at risk of foreclosure. HAF helps them with paying their mortgage, utilities, property taxes and other housing costs.

HAF foreclosure help isn’t guaranteed to all homeowners who apply and won’t necessarily cover all past due mortgage and housing expenses if homeowners get approved. But the HAF program remains a lifeline for many homeowners navigating pandemic-induced financial challenges. It can help save their homes from foreclosure while they find additional mortgage relief.

Who have HAF programs helped so far?

Recent data from the US Department of the Treasury shows over 300,000 economically vulnerable and traditionally marginalized homeowners received over $3 billion in HAF help to date. As of March 31, 2023:

- HAF programs disbursed approximately $3.7 billion to over 318,000 homeowners facing foreclosure.

- In Q1 2023 alone, HAF distributed $1.2 billion in homeowner mortgage relief, a 50% increase from Q4 2022.

- 14 states and two U.S. territories have dispersed more than half of their HAF program funds.

- 49% of HAF's grants reached very low-income homeowners, those earning below 50% of their area's median income.

- 35% of HAF beneficiaries identified as Black, 23% as Hispanic/Latino and 59% as female.

Deputy Secretary of the Treasury Wally Adeyemo remarked, “As state programs assess their remaining HAF funds, the Treasury Department will continue working with recipients to ensure these funds are swiftly delivered to homeowners most in need.”

However, all HAF funds must be distributed before September 30, 2025 when the program expires. If all program funds in your state are depleted before this date, HAF will end there. Please check and apply quickly, if you can.

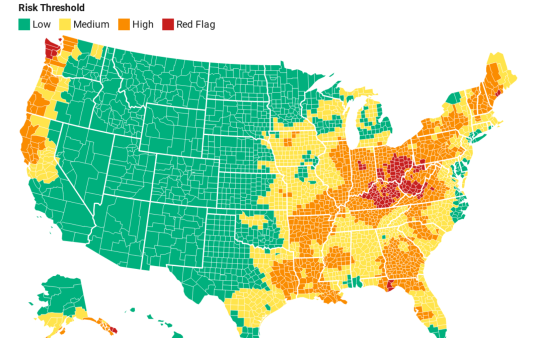

Find out the HAF status in your state

Do I qualify for the Homeowner Assistance Fund?

Several factors determine whether you qualify for help through HAF. This is a grant, which means you don’t have to repay the funds and there’s no credit check required. So, it’s best to get money from a HAF program first to help prevent foreclosure and reduce loan liability. As of August 2023, all homeowners must meet the following criteria for HAF assistance:

- Own and live in the property as their primary residence.

- Face financial hardships affecting mortgage payments because of COVID-19, such as income loss or increased pandemic-related expenses that started after January 21, 2021.

- Meet income eligibility limits based on area median income and household size, typically less than 150% of the median income in your area or $79,900, whichever is higher.

- Be 30 days behind on mortgage payments or show a risk of delinquency or default because of the pandemic.

State-specific exclusions may apply, and eligibility guidelines can vary by state. To determine your eligibility for HAF funds, visit your state's official program website. See below for the latest information on HAF funds availability and eligibility requirements in the states where BlueHub SUN is licensed.

How BlueHub SUN overcomes challenges to timely access to HAF grants

BlueHub SUN has helped more than 20 current SUN clients get over $500,000 in HAF grants to cover missed payments. For clients considering our foreclosure financing options who believe a HAF grant might bring their home loan current, mortgage loan originators might suggest they apply for the grant, then reapply for BlueHub SUN loan products if they can't get a HAF grant.

If foreclosure is imminent, homeowners might apply to HAF and SUN simultaneously to see which one they get first, since BlueHub SUN cannot offer clients getting HAF a loan. For clients who already have been denied HAF, we are an excellent option.

Alternative mortgage relief options

There are multiple alternatives to HAF grants for mortgage relief with their own funding limits and eligibility requirements. But many are loans that require a credit check and have other requirements HAF doesn’t.

If HAF isn't accessible, BlueHub SUN still may be able to help. We offer foreclosure help as loans designed to give homeowners a second chance to regain their financial footing, achieve financial stability and stay in their homes.

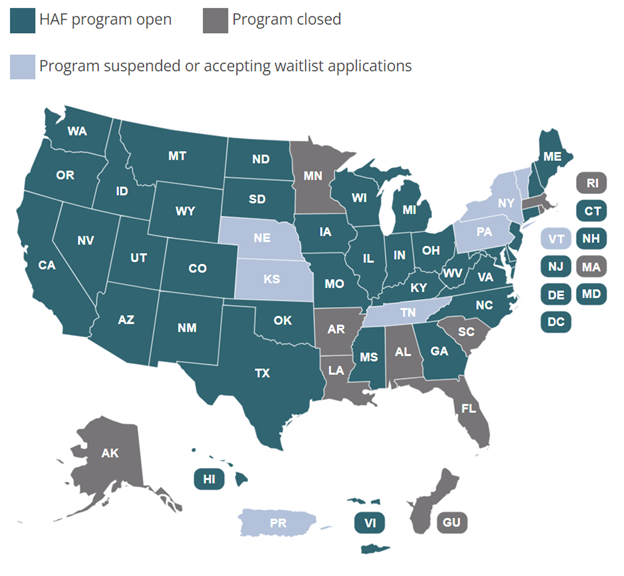

Status of HAF programs where BlueHub SUN operates

As of August 2023, seven of the 11 states where BlueHub SUN offers mortgage loans still had active HAF grant programs providing financial assistance to struggling homeowners. Check your state’s HAF website to determine if there have been changes to your state’s program.

*The map is subject to change over time. To see the most recent version, go to the NCSHA website.