The housing sector is grappling with a rapidly evolving climate-risk landscape. For housing counselors, bankruptcy attorneys and other foreclosure-relief professionals working with homeowners, understanding the broad terrain of climate-driven real-estate disruption is no longer optional—it’s imperative. Research by the First Street Foundation underscores this reality, projecting that U.S. residential real estate may lose up to $1.4 trillion in value over the next 30 years as climate factors bake into insurance, migration and market dynamics. Below are three critical dimensions of this impact—and what housing professionals should keep at top of mind.

1. Insurance Costs & Coverage Availability

Climate change is driving more frequent and severe disasters—hurricanes, wildfires, hailstorms, convective wind events—and the insurance sector is responding in ways that ripple into homeownership and property stability. The U.S. Treasury found that in ZIP codes with the highest expected annual losses from climate-related perils, homeowners paid an average annual premium of about $2,300, which was approximately 80% higher than in the lowest-risk ZIP codes. Meanwhile, non-renewal rates in high-risk areas are significantly elevated. The First Street report similarly flags insurance-cost escalation and coverage shrinkage as core channels through which climate risk eats into property value and owner equity.

For housing professionals, this means: rising insurance bills may strain a homeowner’s ability to service a mortgage; or policies may lapse, leaving homes underinsured or uninsured—exposing both homeowners and lenders to elevated default and loss risk. It also underscores the need for practitioners to help clients anticipate potential premium increases, especially in high-risk areas where coverage can change or disappear with little warning

2. Migration Patterns & Property-Value Shifts

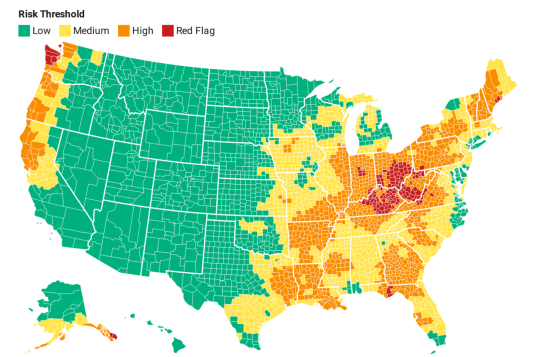

As climate-related risk becomes more visible, migration patterns are shifting—and with them, demand for housing in high-risk geographies may falter. In states that SUN serves, such as Illinois, Maryland and Delaware, the First Street Foundation report shows growing exposure even in areas not traditionally seen as “high risk.”

In Illinois, more than 450,000 homes are now classified as having substantial flood risk—roughly double earlier federal estimates—while in Maryland and Delaware, flood and storm exposures exceed government projections by over twofold. In states not served by SUN, the report highlights even more severe impacts: the five U.S. metro areas projected to face the steepest insurance premium increases are Miami (+322%), Jacksonville (+226%), Tampa (+213%), New Orleans (+196%) and Sacramento (+137%). Collectively, the three largest Sun Belt states—Texas, Florida and California—have absorbed over 40% of the nations $2.8 trillion in natural disaster costs since 1980, illustrating how concentrated these risks have become.

The First Street analysis estimates that impacted properties—those facing elevated hazard, insurance or migration risk—could incur up to $1.47 trillion of value erosion over the next 30 years. While migration is complex (tied to job markets, amenities and affordability), climate risk is increasingly a factor for homeowners, alongside location choice and market pricing. In some markets, the type and condition of a home also play a role, as older or less resilient structures—such as those lacking fire-resistant materials or elevated foundations—can face higher insurance costs and greater exposure to loss.

For practitioners, this signals that homes in once-robust markets may now carry latent risk of depreciation—potentially accelerating foreclosure or underwater scenarios long before traditional triggers such as job loss or rate hikes materialize.

3. Natural-Disaster Frequency, Severity & Homeowner Impacts

The frequency and cost of extreme weather events continue to climb. For example, the Congressional Budget Office reported last year that while hurricanes historically posed the greatest risk, wildfires have emerged more sharply in recent years as catastrophic exposures to insurers. In a separate analysis cited by a Harvard Business School article, from 2013 to 2023, losses paid out due to natural disasters rose from $30.8 billion to $79.6 billion, with a 2017 peak of $116.1 billion.

Moreover, when major events hit, homeowners without insurance, or in markets where insurers withdraw or refuse renewal, may face equity losses, forced sales or abandonment—all scenarios that ripple into community stability and foreclosure risk.

In Florida and Louisiana, insurers have continued to exit or sharply limit coverage following back-to-back hurricane losses, driving non-renewal rates nearly three times the national average. Hawaii has seen similar insurer retrenchment after the 2023–2024 wildfire seasons, while inland regions such as Montana and Wyoming now report rising premiums and early withdrawal activity tied to expanding drought and wildfire risk. Analysts warn that insurance retreat is no longer confined to coastal areas, leaving more homeowners exposed to forced sales, under-insurance and foreclosure-related stress.

These facts reinforce the necessity of integrating climate-risk screening into case management—particularly for homeowners in high-hazard zones who may soon face compounding financial stress.

Implications for Housing Relief Professionals

The convergence of rising insurance costs, migration shifts and escalating disaster risk means that climate change is no longer a distant concern—it is actively reshaping the U.S. housing and foreclosure landscape. For professionals supporting homeowners at risk of default or foreclosure, incorporating this lens into counseling, risk assessment and strategic intervention is critical.

In practical terms, this might include:

- Evaluating a homeowner’s current insurance exposure and their capacity to absorb future premium increases.

- Discussing market devaluation risk tied to residing in high-hazard zones.

- Anticipating migration pressures or declining demand in specific geographies.

- Collaborating with lenders, servicers and community partners on resilience-informed strategies.

By staying ahead of these evolving dynamics, you not only help preserve individual homeownership outcomes but also contribute to stronger, more resilient housing markets and communities.